Overview

This document details the trust account reconciliation procedure in CMPOnline. It provides step-by-step instructions for comparing system records with bank statements, identifying discrepancies, and ensuring proper documentation. Adhering to this process supports regulatory compliance and financial accuracy.

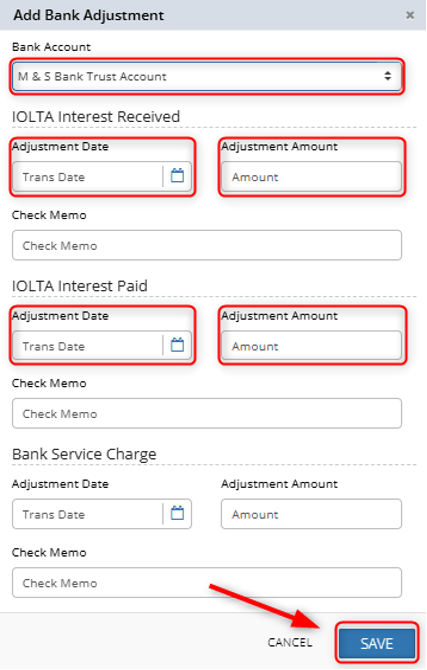

Enter IOLTA Interest

- Go to CMPOnline accounting administrative file (i.e. file #101). If you’re unsure of your administrative file number, contact CMP support.

- Review the bank statement for any IOLTA interest earned or paid, as well as applicable bank service charges, and enter them as needed.

- Navigate to Case File > Financial > Transactions.

- Click on the Bank Adjustment button (bottom right).

- Follow up on any bank charges for reimbursement as needed.

Verify NSF Checks (if any)

- Navigate to Accounting > Reports.

- Select NSF Listing from the Acctg Report dropdown, your bank account, and enter your statement dates to preview the report and compare results with the bank statement.

- If all looks okay, make note of Total NSFs to compare with your reconciliation spreadsheet.

Reconcile Transactions

In CMPOnline, all reconciliation tools are located under the Accounting > Bank Account Recon menu. Here, you will be able to clear checks and deposits, run your Three Way reconciliation spreadsheet to verify compliance, as well as access any necessary tools needed to ensure accuracy (i.e. fix clear dates, run reports to diagnose reconciliation issues, etc.).

Clear Checks and Deposits

- Navigate to Accounting > Bank Account Recon > Clear Checks / Clear Deposits, select your trust account, and enter the statement date as your clear date.

- Compare the list with the bank statement and check the boxes in the cleared column.

NOTE: Clicking on column headers will help you sort accordingly for easy clearing. - When all items on statement are accounted for, compare the Total Check Amount at the top with the bank statement. It should equal Checks/Withdrawals less any NSF’s on the bank statement.

- If it equals, click “Clear Checks” in the bottom right corner. Then click “OK” to “Clear Checks?” and then hit “Close”.

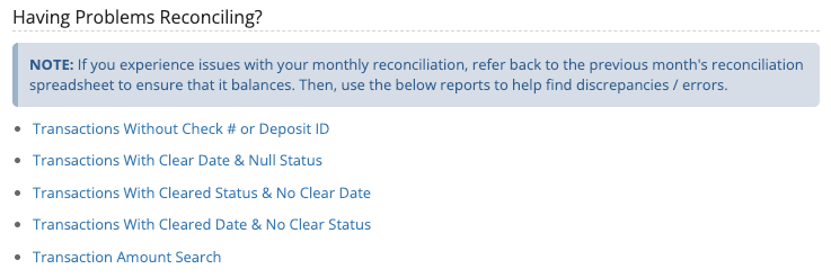

- If it does not equal, you can run reports to help identify problems. Helpful reports are located under the Recon Spreadsheet screen in the Bank Account Recon menu under the “Having Problems Reconciling?” heading.

NOTE: Make sure you clear IOLTA Interest on both the Checks and Deposit Screens.

Run the Reconciliation Report

- Navigate to Accounting > Bank Account Recon > Recon Spreadsheet, fill in the appropriate fields, and click Preview Report to save the excel spreadsheet.

- Open spreadsheet and confirm the following:

- On the Reconciliation tab, the difference should be ZERO and the Three Way Reconciliation Results should all be TRUE.

- NSF Checks tab – Verify NSF Checks match statement.

- Cleared Checks tab – Verify Cleared Checks and Total Debits match statement.

- Cleared Deposits tab – Verify Cleared Deposits match statement.

- If any of the above is incorrect, review the entire spreadsheet for possible reasons.

Note: To diagnose possible reconciliation issues, re-visit the Recon Spreadsheet screen and run the appropriate “Having Problems Reconciling?” reports. - If all is correct, save to your file system.

Note: It is highly recommended to also image your report to your administrative file in CMPOnline.