In the ever-evolving landscape of debt collection, lawyers are faced with complex rules and regulations to shift through. With countless regulations and guidelines, it’s easy for legal professionals to feel overwhelmed with updates and changes to laws. Amidst this legal terrain, the introduction of Regulation F has brought significant changes. Understanding and complying with these rules is crucial for legal professionals, as non-compliance can have far-reaching consequences.

In this blog post, we explain the intricacies of Regulation F, providing lawyers with the insights and guidance they need to navigate this new regulation. Join us as we unravel the key provisions, compliance requirements, and practical tips to stay ahead in the field of debt collection while staying firmly within the bounds of the law.

Understanding Regulation F: An Overview of Debt Collection Regulations

Regulation F, or Reg F as it’s commonly known, is a set of federal rules that dictate how you should go about collecting debts.

Regulation F is designed to implement the Fair Debt Collection Practices Act (FDCPA) by providing specific rules and guidelines for third-party debt collectors. Lawyers need to recognize that the regulation addresses various aspects, from communication methods to the disclosure of consumer rights. Under Regulation F, understanding the definition of a ‘debt’ and ‘debt collector’ is crucial. It’s also vital to know the revised rules surrounding permissible communication channels, the ‘mini-Miranda’ warning, and the limitations on frequency and consent. With these basic understandings, lawyers can lay the foundation for navigating Regulation F effectively, ensuring they remain in compliance and uphold ethical debt collection practices.

Scope and Applicability of Regulation F

The scope of Regulation F is vast, touching on different types of credit and collections entities. It has a profound effect especially on third-party collectors who are deeply involved in the debt collection process.

This regulation encompasses various types of consumer debts, such as open-end credit cards, closed-end loans (e.g., mortgages or car loans), and other forms of debt. Hence, it’s clear that the breadth covered by this rule extends beyond just traditional financial institutions.

A key element here is understanding that even if you’re an entity indirectly related to the actual lender or creditor – for instance a law firm collecting debts owed to its clients – you’d still fall under the purview of Regulation F. This brings into light the importance for all parties engaged in any form of debt recovery actions being aware of their obligations under these rules.

Digging Deeper: Third-Party Collectors and The Law

The role played by third-party collectors can’t be understated when discussing Regulation F applicability. In fact, it could well be argued that they sit at the very heart of this regulatory framework. Their operations have significant implications both from a compliance perspective as well as ensuring protection for consumers’ rights during debt collection efforts.

In essence though, remember this – irrespective of your business type or size – if you’re dealing with consumer debts, it is essential you are up to speed with Regulation F requirements. After all, ignorance certainly doesn’t excuse non-compliance.

Navigating debt collection? Know that Regulation F casts a wide net. It's not just for traditional lenders, but any entity involved in collecting consumer debts. From credit cards to car loans, if you're in the game, this rule… Share on XRequirements for Communication under Regulation F

If you’re in the debt collection business, getting your communication practices right is key. And that’s where Regulation F steps in. It covers communications related to debt collection and sets specific rules to ensure fair play.

The guidelines are clear – collectors can’t contact consumers at inconvenient times or places without their consent or a court order. So, no calls before 8 AM or after 9 PM unless the consumer says it’s okay.

Collectors also need permission from consumers to contact them at work if such communication is prohibited by employer policies. These requirements aim to protect consumer rights while ensuring respectful interactions between both parties during the debt collection process.

Avoiding Third-Party Disclosures

To keep things confidential, Reg F prohibits collectors from revealing a consumer’s debts to third parties without prior consent except under limited circumstances permitted by law.

In situations where direct interaction with the debtor isn’t possible due to reasons like unavailability or refusal of communication, some leeway is provided but within strict boundaries defined by Regulation F against debt collectors.

Digital Communications – The New Age Method

Emails and text messages provide a useful tool for collection firms. Yes, digital methods of debt collection have been given thumbs up too, as per Consumer Financial Protection Bureau (CFPB) collections norms, but again with certain checks and balances in place because protecting consumer privacy remains paramount here too.

Navigating the world of debt collection? Regulation F has your back. Ensuring fair play, it keeps communications respectful and consumer rights protected. Thumbs up to digital methods too – with checks in place, of course.… Share on XProhibited Practices under Regulation F

The rules of the game in debt collection have been clearly outlined by Regulation F. It is a firm stance against harassment, false representations, and unfair practices. But what exactly falls under these categories?

Identifying Unfair Practices

Unwanted calls at odd hours or incessant demands for payment can feel like a vulture circling overhead for debtors. This isn’t just annoying, it’s illegal according to Regulation F. Debt collectors must respect consumers’ rights and time frames when reaching out about an outstanding balance.

Falsely representing oneself as an attorney or government representative is another prohibited practice. Misrepresenting the amount owed also gets two thumbs down from regulators—accuracy matters.

Misleading communication tactics are also on the blacklist—Providing incomplete information about debts violates consumer rights and goes against fair play principles laid out by federal debt collection laws.

Violation penalties for these no-nos range from hefty fines to legal action.

Enforcement and Penalties under Regulation F

The enforcement of Regulation F is a serious matter. The CFPB is a vital part of ensuring debt collectors adhere to the regulations established by Regulation F. But what happens when they don’t? Let’s look at some of the consequences.

When non-compliance with Regulation F occurs, it triggers penalties for the offending party. This can range from monetary fines to more severe actions like license revocation or even criminal charges in extreme cases.

The Role of CFPB in Enforcement

The CFPB has the power to investigate and take legal action against those companies who violate Regulation F, a federal consumer financial law. It carries out investigations and can take legal action against companies violating these regulations.

This regulatory body not only ensures compliance but also works towards creating an equitable environment where both consumers and legitimate businesses are protected.

Potential Consequences of Non-Compliance

If you fail to comply with the rules set by Regulation F, be prepared for hefty consequences. These include potential civil liability, such as actual damages suffered by a consumer, statutory damages up to $1,000 per violation and attorney’s fees if legal proceedings are initiated.

Besides these individual liabilities, violators could face additional class action litigation risks which may lead to substantial financial loss due to their cumulative nature. It is more advisable to take proactive measures to avoid penalties from occurring.

Disclosures and Notices under Regulation F

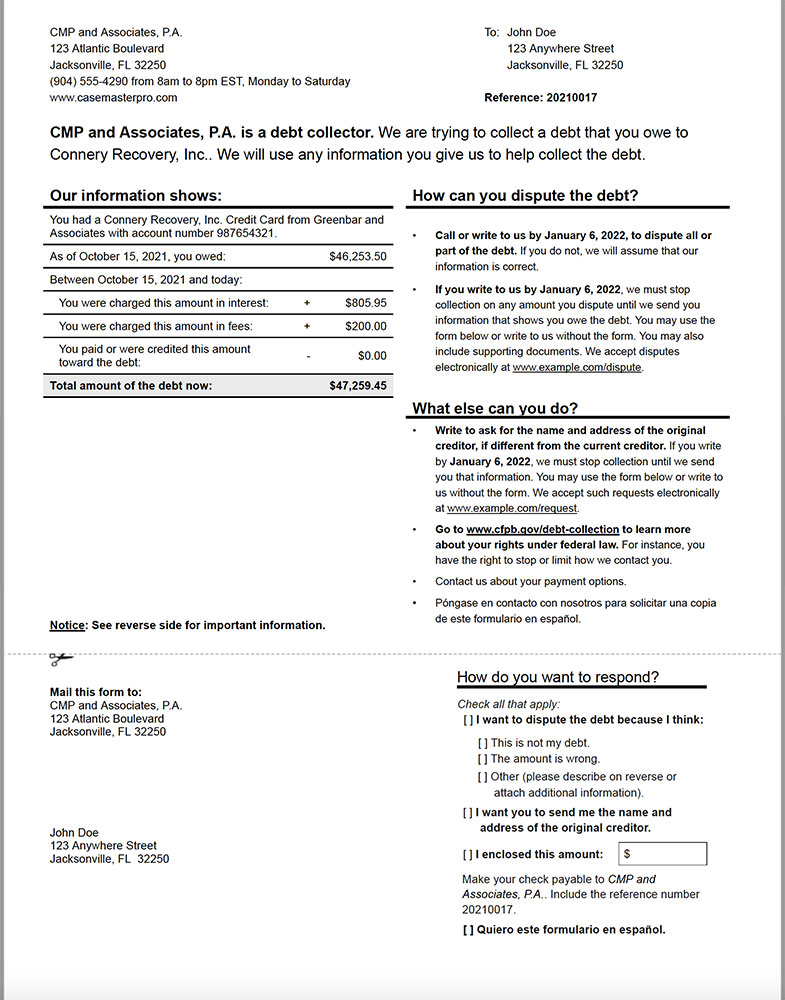

Disclosures and notices under Regulation F, with a special focus on validation notices, carry significant weight in the debt collection landscape. These notices play a pivotal role in informing consumers about their rights and the debt they owe.

The Role of Validation Notices

Regulation F sets out specific requirements for validation notices, including the need to provide a clear and concise statement regarding the debt, the consumer’s right to dispute the debt, and the timeframe within which disputes must be made.

Sending a model validation notice is crucial for debt collection lawyers to ensure legal compliance, inform debtors about their rights, provide a platform for dispute resolution, build credibility, mitigate legal risks, and streamline the debt collection process. It is both a legal requirement and a strategic practice that contributes to fair and efficient debt collection.

Lawyers must emphasize the importance of crafting validation notices that are transparent, comprehensive, and comply with the regulation’s stipulations. By ensuring that consumers receive accurate and intelligible information, legal professionals not only fulfill their obligations under the law but also contribute to building trust and fairness in the debt collection process.

Tackling debt collection? Don't fret. Regulation F keeps you in compliance. Streamline with software like CMPOnline's Debt Collection Software. #DebtCollection #RegulationF Share on XReview of CMPOnline’s Debt Collection Software

For lawyers dealing with legal debt collection, navigating the complexities of Regulation F can be a daunting task. But with CMPOnline’s SaaS-based debt collection software, this process is simplified.

Recordkeeping and Reporting Obligations under Regulation F

Accurate documentation is paramount to ensure compliance in debt collection. Compliance isn’t just about following rules – it’s also about proving you’ve followed them. This means keeping meticulous records for each case, including details like contact attempts, payment arrangements made, and validation notices sent. CMPOnline simplifies the process of validation notices. When a client accesses CMPOnline, they gain the ability to automatically generate validation notices with ease. This feature effortlessly retrieves all relevant debtor information, streamlining and simplifying the entire process.

This attention to detail will help ensure compliance with reporting obligations under Regulation F as well. These obligations include providing annual reports to regulatory bodies detailing your firm’s activities over the past year – an intimidating process that our software simplifies.

Making Recordkeeping Easier

CMPOnline offers tools designed specifically for lawyers handling legal debt collections. We know how overwhelming paperwork can get when dealing with multiple cases at once.

Our system automatically logs every action taken on a file into its history report – whether it’s phone calls made or received, payments processed, or letters mailed out – giving you instant access to comprehensive records whenever needed without extra effort from your end.

Simplifying Reporting Obligations

Besides streamlining record-keeping processes, CMPOnline helps tackle reporting tasks too. With detailed analytics available at your fingertips through easy-to-use dashboards, generating those crucial annual reports becomes less cumbersome than ever before.

Submit any questions you might have right away. And remember: Keeping up-to-date records doesn’t just protect consumers—it protects you by ensuring all actions are accounted for.

Tired of juggling debt collection paperwork? CMPOnline's software is your ally in mastering recordkeeping under Regulation F. Keep track effortlessly and protect yourself with up-to-date records. #LegalTech #DebtCollection Share on XFAQs in Relation to Regulation F

What are the credit reporting requirements for Reg F?

Creditors must keep accurate records and report correct information about a debtor’s status under Reg F. Incorrect reporting could lead to penalties.

What is Regulation F?

Regulation F sets the rules for debt collection under the Fair Debt Collection Practices Act. It governs how collectors interact with borrowers.

What act is Regulation F part of?

Regulation F is part of the Fair Debt Collection Practices Act (FDCPA). This legislation protects consumers from unfair or abusive debt collection practices.

What is the Regulation F in NY?

New York’s version of Regulation F mirrors federal law but adds extra consumer protections. The details can vary, so check local laws to be sure.

Conclusion

In summary, understanding and applying Regulation F is a fundamental aspect of your role in debt collection law. This regulation, with its wide-ranging implications, governs communication in debt collections, delineates prohibited practices, outlines disclosure obligations, and establishes penalties for non-compliance. By mastering the intricacies of Regulation F, you not only ensure compliance but also enhance the efficiency of your legal practice.

For legal professionals committed to optimizing record-keeping and compliance, Case Master Pro offers a specialized SaaS-based Debt Collection Software. Tailored to the needs of legal practitioners, our comprehensive tools simplify the navigation of various collection regulations. Elevate your debt collection strategy by requesting a FREE DEMO from Case Master Pro today. Revolutionize your approach and ensure seamless compliance with the ever-evolving landscape of debt collection cases.