As you may be aware, the Fair Debt Collection Practices Act (Regulation F) will be going into effect on November 30, 2021. If your firm collects on consumer debt, you will likely be affected by these changes. You can access an FAQ here.

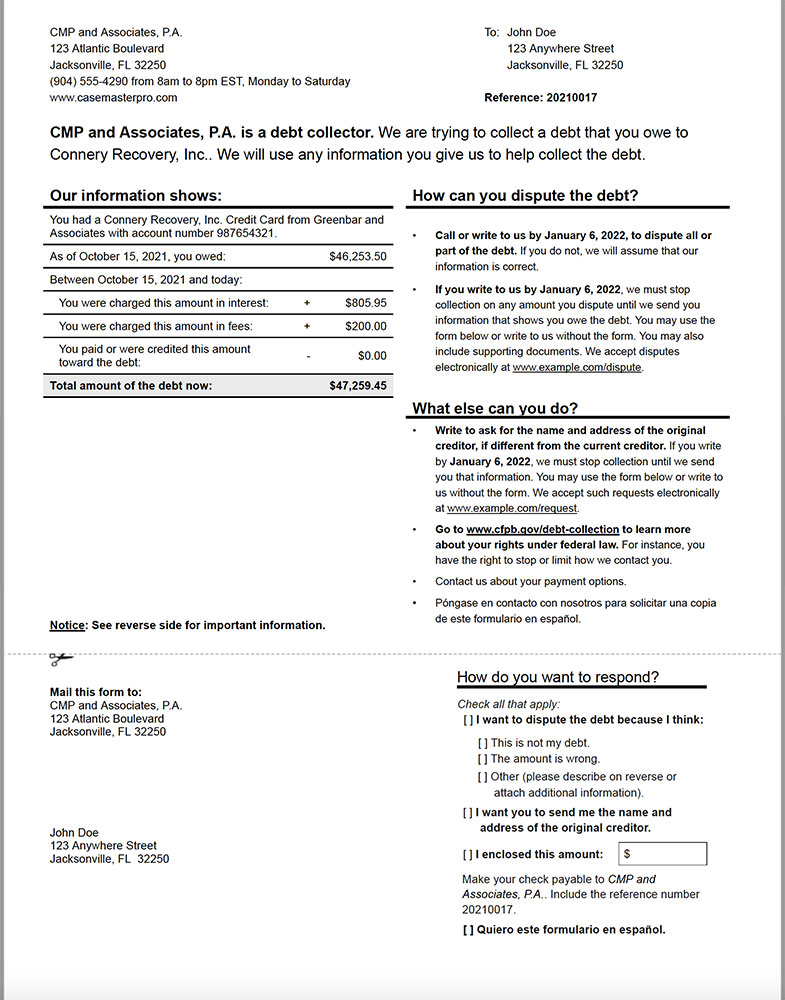

To aid firms in this transition, we have created a sample Model Validation Notice document template (see attached) that we can upload to your Document Templates area in CMPOnline. If you’d like a copy of the actual template, or if you would like for us to upload this template, please reach out to our support line, and we will provide it to you. Your firm will need to determine the correct merge fields that you will be using within the template (based on how you internally work your cases) as well as perform all of the testing required against the template to verify the information is merged correctly.

In addition, we’ve also added a few (optional) fields to the Case File > Accounts screen for Itemization Date, Itemization Amount, Post Itemization Credits, and Post Itemization Expenses which can be used to replace any of the merge fields that we’re using in the Model Validation Notice template. Of course, these fields may not be necessary depending on your state laws and how you work your case files in CMPOnline. To enable these fields, you would navigate to Administration > Lookups > Account Types, edit any account type for which you perform consumer collections, and check the box under “Other Fields” for “Show Itemization Fields?”.

Finally, we’ve also added the ability to track debtor call attempts, so that collectors are notified of the number of telephone contact attempts in a 7 day period. If you are interested in more information on this feature, please let us know.

If you have any questions, please let us know. And thank you for being a valued CMPOnline customer!