Legal Debt Collection is a complex field, requiring an intricate understanding of both legal and financial principles. This blog post aims to provide comprehensive insights into this realm, demystifying various aspects such as types of collections, industry solutions, and effective collection strategies.

We delve into the critical legal requirements that govern debt collection practices under acts like the Fair Debt Collection Practices Act (FDCPA) and Consumer Credit Protection Act (CCPA). Understanding these laws passed by Congress can help you navigate through potential pitfalls in your pursuit of unpaid debts.

Further on, we explore resources available for debt collection law firms and discuss best practices that traditional bill collectors or creditor’s internal collectors should adhere to for successful recoveries. We also shed light on essential features to look out for when choosing software for managing Legal Debt Collections efficiently.

Types of Collections

In the realm of debt recovery, attorneys and law firms handle various types of collections. A comprehensive understanding of these categories is crucial for effective management and successful collection efforts.

Consumer Debt

Consumer debt includes credit card debts, personal loans, auto loans, student loans, medical bills, and more. These are typically owed by individuals to banks or other financial institutions. The Consumer Financial Protection Bureau (CFPB) provides guidelines on how to collect such debts.

Commercial Debt

Commercial debt involves businesses owing money to other businesses. It could be due to unpaid invoices for goods or services provided or loan defaults.

Judgment Collection

Judgment collection refers to a court-ordered obligation where the debtor has been legally ordered to pay a certain amount after losing a lawsuit. Collecting this type of debt often requires specialized legal knowledge and tools like wage garnishments and property liens.

Credit Card Charge-offs

Credit card charge-offs occur when credit card companies declare an account as uncollectable after several months of non-payment. They then sell these accounts off in bulk at discounted rates to collection agencies who try their best using various strategies, including legal action if necessary.

Retail Collections

Retail collections involve consumer debts related specifically to retail purchases made through store credit cards issued by retailers themselves rather than traditional banking institutions.

Lawyers and legal professionals play a crucial role in managing different types of debt collections, from consumer debts to judgment collection. #DebtCollection #LegalProfessionals Share on XIndustry Solutions

In the world of legal debt collection, lawyers and law firms need industry-specific tools to make their lives easier. These solutions help manage cases and keep up with ever-changing regulations.

SaaS for Legal Debt Collection

Check out Case Master Pro, a SaaS-based solution designed just for lawyers and legal professionals in debt collections. It has everything you need, from case management to billing and accounting, all in one convenient place.

The Importance of Case Management

A solid case management system is a must-have. It keeps track of your caseload and debtors, making sure you have all the important data at your fingertips. Plus, it helps automate tasks like generating documents and reminding users of important deadlines.

Billing & Accounting Features

Your software should have top-notch billing and accounting features to help your firm stay afloat. Say goodbye to manual data entry errors with seamless billing entries and automated invoicing.

Paperless Office Capabilities

Go green and get organized with a paperless office. Storing and finding digital records is straightforward, resulting in a tidier work area.

Data Security Measures

In this digital age, security is a big deal. Make sure your software has rock-solid security measures to keep client data safe and sound. Trust and regulatory compliance are key.

Lawyers and legal professionals in debt collections can streamline their workflow with Case Master Pro, a comprehensive SaaS solution. #LegalTech #DebtCollection Share on XCollection Strategies

Creditors may utilize various methods to reclaim their funds from debtors who are resistant or unable to pay. These strategies vary in effectiveness, depending on the means and collectability of a debtor.

Demand Letters

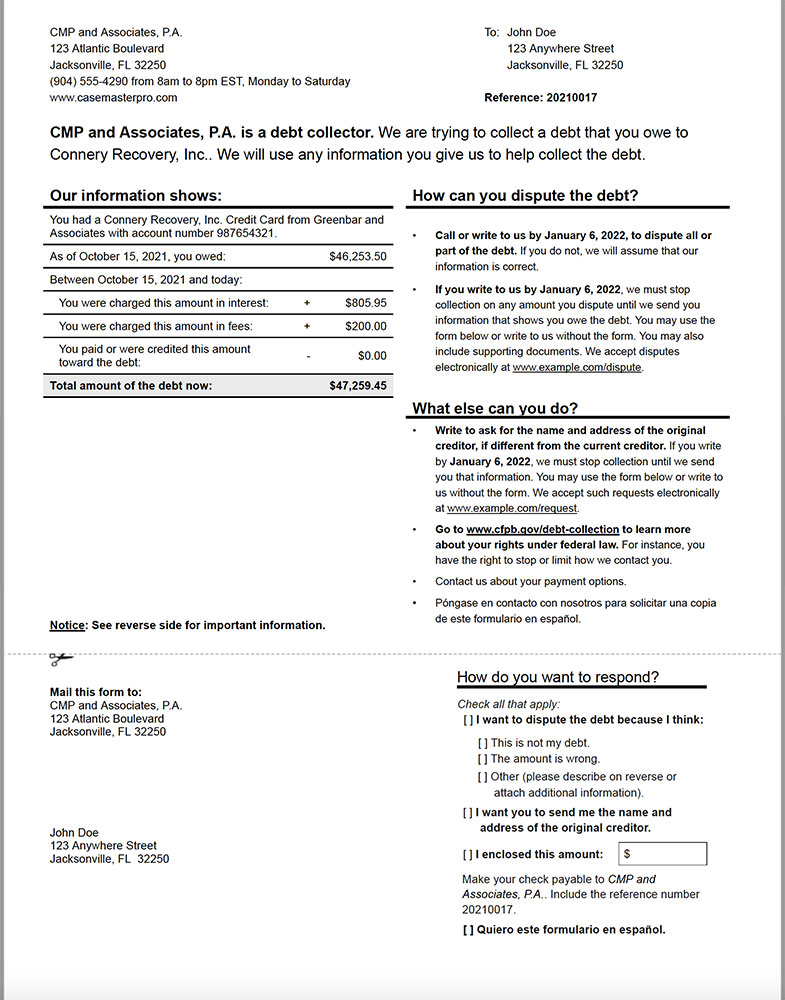

Sending communication to the debtor letting them know of the debt they owe is the first step in legal debt collection to include certain validation information about the debt. A good example would be the CFPB Debt Collection Validation Notice required by the Consumer Financial Protection Bureau (CFPB).

Filing Suit

If a debtor doesn’t respond to initial demands for collection, it’s time to file a lawsuit against the debtor. This legal action can lead to a judgment in the creditor’s favor, opening up more options for debt recovery.

Judgments

Once a court grants a judgment, creditors gain the ability to take additional actions to collect the debt. These actions may involve asset searches or determining the debtor’s place of employment.

Wage Garnishment & Bank Levies

When debtors remain unresponsive, wage garnishment and bank levies become viable options. Wage garnishment allows creditors to deduct money directly from the debtor’s paycheck, while bank levies involve freezing and seizing funds from the debtor’s bank account.

Property Liens & Levies

If the debtor owns property, creditors can put a lien on it to ensure repayment. And if that isn’t effective, they can go for a levy and seize physical assets like cars or houses.

To keep things ethical, both parties should know their rights under federal law.

Creditors in legal debt collection have various strategies like filing lawsuits, obtaining judgments, wage garnishment, and property liens to recover their money. #DebtCollection #LegalStrategies Share on XLegal Requirements

Understanding the legal requirements can save attorneys time and money while running a successful law firm.

The Consumer Financial Protection Bureau (CFPB) has set some rules for collectors. One of them is the Debt Collection Validation Notice. It’s an essential step for all consumer debt collectors that cannot be skipped.

Debt Collection Validation Notice

- Date of Issue: Let’s start with the basics. When was the notice sent?

- Name of Creditor: Who’s the owner of the debt? It’s imperative the debtor understands who they owe money to.

- Total Amount Owed: How much money does the debtor owe? If a collector expects a debtor to respond without having to file suit, they need to provide all the details, including any fees or interest that might have accrued.

- Rights as a Consumer: The consumer needs to know what they can do if they want more information or disputing their debt.

Lawyers must comply with regulations such as the FDCPA, FCRA and TCPA in order to stay abreast of legal developments.

To stay in the loop, check out The National List of Attorneys.

Understanding the legal requirements is essential as it ensures that all parties involved are well-informed and treated fairly. By adhering to these requirements:

- Creditors Secure Payment: Creditors can effectively pursue the collection of owed funds while operating within the boundaries of the law. This allows them to protect their financial interests and maintain a fair and transparent process.

- Fair Treatment for Debtors: Debtors are entitled to fair treatment throughout the debt collection process. Knowledge of legal requirements ensures that debtors’ rights are upheld, protecting them from harassment, deception, or unfair practices. This fosters an environment of mutual respect and transparency.

- Attorneys Provide Professional Services: Attorneys play a vital role in the debt collection process. Their understanding and compliance with legal requirements enable them to provide professional guidance and representation to their clients. By upholding legal standards, attorneys can navigate the complexities of debt collection and advocate for their clients’ best interests.

Overall, a foundation of legal knowledge benefits everyone involved in the debt collection process. It promotes fairness, transparency, and professionalism, fostering a system where creditors can secure their rightful payments, debtors receive equitable treatment, and attorneys provide effective services to their clients.

Lawyers in debt collection must understand legal requirements to protect both creditors and debtors. Stay compliant, stay out of trouble. #DebtCollection #LegalRequirements Share on XCollection Resources

These tools not only help in collecting debts but also ensure compliance with legal requirements such as the CFPB Debt Collection Validation Notice.

Tools for Law Firms

Collectors utilize databases like LexisNexis and RNN to find debtors or uncover hidden assets.

Resources for Attorneys

To keep abreast about industry standards, laws passed by Congress, or any changes in local state attorney’s office procedures, attorneys rely on professional organizations. The National Creditors Bar Association (NCBA) offers education and networking opportunities for credit professionals.

The Association of Credit and Collection Professionals (ACA) provides resources including training programs, webinars, publications, and more – all aimed at helping members navigate the intricacies of debt collection law firms’ operations.

The Commercial Law League of America (CLLA) is another excellent resource offering valuable information about commercial law practices, including traditional bill collectors’ strategies and new approaches adopted by modern-day debt buyers.

These are just some of the many resources available to creditors and attorneys.

New Technologies

New technologies are changing the standards up in the debt collection world. Some cell phone companies now let bill collection agencies send reminders via text messages. But remember, these methods must comply with regulations under the consumer credit protection act to ensure fair treatment towards consumers while effectively ending collection procedures. It’s like abiding by the law, but with a tech-savvy approach.

Key Takeaway: In the world of legal debt collections, collectors and attorneys rely on various resources to collect debts and stay compliant with regulations. Creditors use databases like LexisNexis and RNN to locate debtors and uncover hidden assets, while also turning to professional organizations like NCBA, ACA International, and CLLA for education, networking opportunities, and information about industry standards. New technologies are also changing the game by allowing bill collection agencies to send reminders via text messages while ensuring fair treatment towards consumers under the consumer credit protection act.

Best Practices

In the realm of debt collection, it’s crucial to adhere to best practices. Not only does this ensure compliance with laws such as the Consumer Credit Protection Act and the Fair Debt Collection Practices Act, but it also fosters trust between debt collectors and consumers.

1. Clear Communication:

Be open and straightforward about your identity, purpose, and intent when communicating with a debtor. Avoid using legal jargon that might confuse a debtor.

2. Respect Privacy:

Adhere strictly to privacy laws by not disclosing information about a person’s debts without their permission.

3. Accurate Documentation:

Keep precise records of all communication with debtors – including phone calls, emails, or letters sent/received.

4. Compliance with Laws:

The Mini-Miranda Rights equip consumers with the knowledge and understanding of their rights under the FDCPA; The Fair Debt Collection Practices Act, which regulates how collections can be pursued; The Consumer Financial Protection Bureau rules on dealing with consumers; Laws passed by Congress like the Telephone Consumer Protection Act that governs contact via cell phones; Your local state attorney’s office guidelines for fair practices in collecting debts.

5. Training & Education:

A well-educated team is less apt to commit errors that could result in legal action or penalties from agencies like the CFPB and FTC.

6. Professionalism:

Maintain professionalism at all times when dealing with customers regardless of their response or attitude towards your attempts at recovering debts owed.

7. Follow-up Procedures:

Create an effective follow-up system for unpaid bills – this could include sending reminder notices before escalating matters through small claims courts if necessary.

8. Credit Reporting:

If a debtor fails to pay after repeated attempts at recovery, report them appropriately to credit bureaus (with proper notice).

9. Partnering with Legal Experts:

Sometimes it may be necessary to involve attorneys specialized in debt collection procedures, especially where large sums are involved.

10. Use Technology to Your Advantage:

Leverage technology tools such as Case Master Pro, which offers features designed specifically for managing case files, billing/accounting needs, and generating documents. This will help streamline operations while ensuring adherence to industry standards and regulations.

Key Takeaway: The best practices for legal debt collections include clear communication, respecting privacy laws, accurate documentation, compliance with relevant regulations and laws, training and education of staff members, maintaining professionalism in interactions with customers, implementing effective follow-up procedures for unpaid bills, reporting delinquent debtors to credit bureaus when necessary, partnering with legal experts as needed, and utilizing technology tools like CaseMasterPro.com to streamline operations. These practices ensure compliance with industry standards while fostering trust between debt collectors and consumers.

Must-Have Debt Collection Software Features

In the realm of legal debt collection, it is crucial to have software that combines power, efficiency, and security. Here are some essential features to consider when selecting debt collection software:

Case Management

Opt for a robust case management system that allows you to efficiently track and manage debtor information. Think of it as having a reliable personal assistant who keeps all case details organized.

Billing and Accounting

Streamline your financial processes by choosing software with integrated billing and accounting capabilities. This feature enables you to manage debtor payments, client fees, court costs, IOLTA Trust Accounts, and more effectively.

Paperless Office

Embrace the digital era by opting for a software solution that offers a paperless office feature. This feature allows you to eliminate unnecessary paperwork, leading to cost and time savings associated with printing and filing documents.

Security and Administration

Protect sensitive client information with top-notch security and administration features.

Reporting

Assess performance and provide clients with their case file data easily with the ability to generate custom reports.

Document Generation & Management

Create and customize legal documents with ease and keep them organized for future use.

Software Integration

Integration with other tools like Microsoft Office and QuickBooks can make your workflow smooth. Choose wisely and ensure you select the perfect software for your business requirements. Don’t rush, take your time to evaluate different options.

Level up your legal debt collection with CMPOnline, providing must-have software features like case management, billing/accounting, paperless office, security/administration, reporting, document generation, and more. Streamline your… Share on XConclusion

Understanding the different types of collections and implementing industry solutions is crucial for successful legal debt collections.

By using effective collection strategies and staying up-to-date with legal requirements, debt collection attorneys can maximize their chances of recovering debts for their clients.

Ready to take your practice to the next level of Legal Debt Collection? CMPOnline offers SaaS-based Debt Collection Software tailored specifically for lawyers like you. With our tools at your disposal, navigating through different techniques in legal debt collection becomes easier than ever before. Visit Case Master Pro and request a FREE DEMO today to start transforming how you handle debt collection cases!