Understanding the Fair Debt Collection Practices Act is key for both professionals in the collections field and consumers facing debts. This legislation shapes how debts are collected, ensuring practices are fair and legal. You’ll get to grips with amendments that have refined its scope over time, including recent updates that impact consumer rights.

Dive into what behaviors cross the line into deception under this law. Learn about the consumer’s rights, like their right to verify a debt’s validity—a critical stage in the debt collection process. Plus, we’ll cover penalties collectors face when they break these rules because knowing consequences can protect your firm.

These insights help guide collectors on staying within legal bounds as they work to recover owed amounts—crucial info that impacts financial well-being and professional conduct alike.

Legal Framework of the Fair Debt Collection Practices Act

The Fair Debt Collection Practices Act (FDCPA) stands as a safeguard against overzealous debt collection tactics, ensuring that debt collectors maintain ethical standards and respect consumer rights. Its comprehensive legal structure underwent substantial enhancement in 2010 through Public Law 111-203, title X, 124 Statute 2092, amplifying protections for consumers while delineating clear operational boundaries for debt collectors.

Amendments to the Fair Debt Collection Practices Act

In response to evolving financial landscapes and credit markets, amendments were introduced to enforce the FDCPA’s relevance in modern-day transactions. Notably, these changes sought to better protect consumers from predatory behaviors without stifling legitimate efforts by creditors to collect debts owed. As such practices can influence credit report outcomes and individual privacy significantly, legislative adjustments became imperative.

The Federal Trade Commission (FTC), along with other federal agencies like The Consumer Financial Protection Bureau (CFPB) and The Federal Reserve System play pivotal roles in the administrative enforcement of these provisions. Together they work toward eliminating abusive debt collection practices.

Prohibited Conduct Under the FDCPA

Certain conduct is strictly prohibited under this Act because it protects individuals from unfair treatment during collection attempts on household purposes or business-related debts alike. Harassment or abuse by debt collectors are specifically barred. Activities such as incessant calling at unusual times or using misleading representations constitute violations of trust between debtor and collector.

This is strengthened further when considering that deceptive communication strategies not only impinge upon consumers’ rights but also undermine confidence within market operations itself—therefore fostering transparent dialogue becomes key even when attempting to collect debt obligations responsibly.

Rights and Protections for Consumers Under the FDCPA

A core tenet established by this landmark legislation pertains directly towards safeguarding consumers’ rights: particularly their ability to question validity claims made regarding outstanding balances via validation requirements outlined within statutory provisions themselves.

Collectors must furnish details pertaining to the original amount if so requested, thus allowing disputes to occur before any potential negative reporting might substantially impact someone’s financial standing.

The stop communications directive provides individuals with a mechanism to halt all contact when needed, offering relief to those who feel overwhelmed. At the same time, it preserves their rights to negotiate settlement terms if they choose to pursue that option, ensuring a fair process rather than one driven by pressure or coercion.

This framework is designed to protect individual rights during the often difficult process of settling overdue accounts. Society recognizes the importance of these principles for maintaining fairness and respect.

Key Takeaway: The Fair Debt Collection Practices Act shields consumers from aggressive debt collectors, demanding all parties play fair and respect the debtors’ rights. The law’s been beefed up to keep pace with today’s credit scene—allowing collectors to pursue while keeping consumers feeling safe during challenging times.

Prohibited Conduct Under the FDCPA

The FDCPA clearly delineates what practices are off-limits, emphasizing ethical and fair treatment of consumers. Beyond compliance, comprehending the nuances of prohibited conduct serves as a shield against legal repercussions and enhances the reputation of legal professionals in the debt collection sphere.

Harassment or Abuse by Debt Collectors

The Act is explicit in prohibiting harassment and abuse by those attempting to collect debts. But what does this mean? Essentially, any conduct that oppresses, torments, or intrudes upon an individual’s peace is not tolerated under the law. This includes incessant calling at unusual times which could disrupt a person’s tranquility—typically before 8 AM or after 9 PM—or at their workplace if such calls are forbidden by the employer.

Beyond timing and frequency of communication, threats of violence or harm, as well as profane language used with intent to intimidate, also fall squarely into prohibited behavior. Moreover, publicizing someone’s name on a “bad debt” list transgresses boundaries set for privacy under federal regulation unless it’s requested through consumer reporting avenues authorized by the FDCPA.

False or Misleading Representations in Debt Collection

In addition to curbing harassment and abuse, eliminating deceptive practices stands out as one of the cornerstones of fair debt collection laws—a foundation solidified against false representations within this arena. The use of deception can manifest in various ways. From impersonating government officials or attorneys when they aren’t involved with collecting a particular debt owed, to suggesting nonpayment will result in arrest without proper legal grounds, is misleading representation condemned unequivocally within industry standards enforced rigorously since inception.

Falsifying documents related to credit reports remains another serious infraction. This is outlined explicitly pertaining to misrepresentation, particularly given potential repercussions impacting creditworthiness long term. Therefore, strict adherence toward honesty becomes imperative here above all else. Numerous private entities work alongside the Federal Trade Commission to ensure compliance across the board, thereby preserving integrity within the entire process, regardless of the circumstances surrounding each case individually.

Honesty in managing your credit information is not just important—it’s absolutely critical. Banks and the FTC are watching closely, making sure everyone plays by the rules to keep things fair. Remember, cutting corners could land you in a heap of trouble down the line. It pays off to be truthful from the get-go.

Key Takeaway: The Fair Debt Collection Practices Act (FDCPA) forbids debt collectors from harassing consumers, making threats, or lying. Calls before 8 AM or after 9 PM are not allowed. Lying about being a lawyer or government official is also a big no-no. And messing with a consumer’s credit report details could seriously backfire.

Consumer Rights and Protections Afforded by the FDCPA

The provisions of the FDCPA are designed to protect consumers from abusive debt collection tactics and give them avenues for recourse when their rights have been violated.

Validation of Debts Requirement

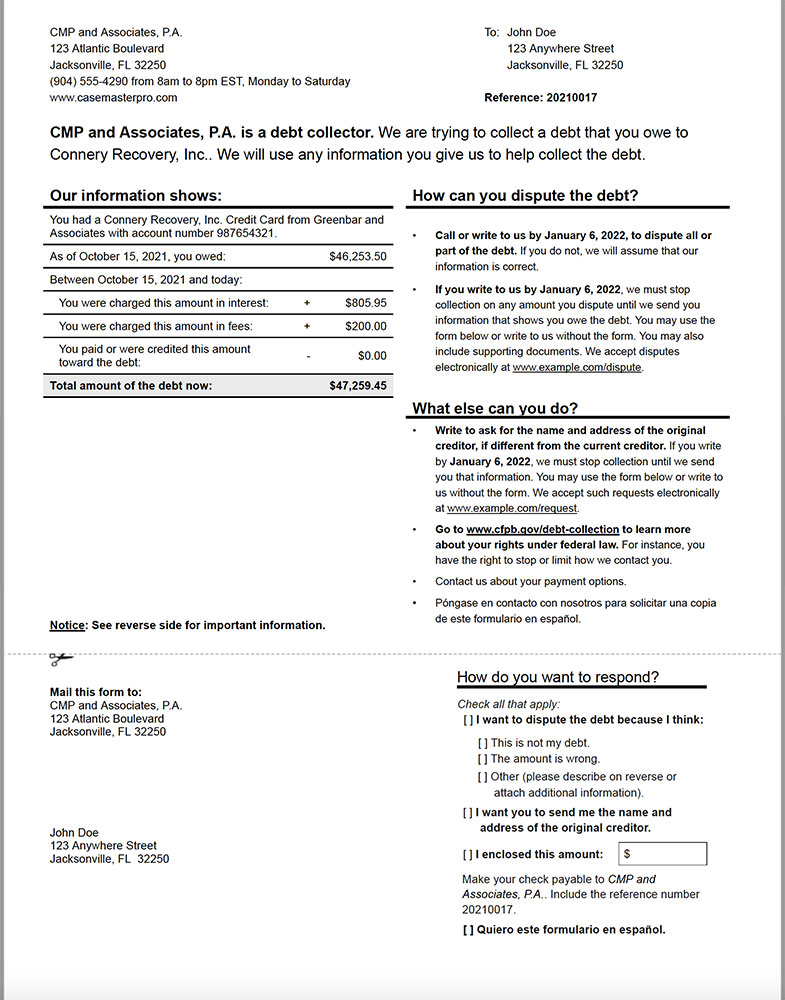

One key consumer protection under the FDCPA is the right to the verification of debts. If a debtor questions a debt’s validity, he or she can ask the collector for proof. This demand must be respected. If requested within 30 days of first contact, the collector must pause all collection efforts until they provide adequate validation.

This statute ensures that individuals are not strong-armed into paying debts without evidence, substantiating their obligation. This is vital knowledge in practice since an incorrect or fraudulent claim on someone’s credit report could cause significant financial harm.

To facilitate this process effectively, attorneys may use debt collection software tailored for legal professionals such as CMPOnline. These tools help track disputes efficiently and ensure compliance with these critical regulatory requirements set forth by federal fair debt laws, like those provided in the statutory text of the FDCPA.

Ceasing Communication Upon Consumer Request

An equally crucial provision is a consumer’s ability to cease communication with collectors simply through making such a request. Once made in writing, collectors must stop contacting them, except under specific circumstances—such as informing them about potential legal actions or administrative enforcement measures being taken against them.

This part of fair debt collection practices prevents undue stress upon the debtor caused by persistent calls at unusual times or work disruption due to untimely contacts from creditors seeking payment—a common unfair practice before these regulations came into effect.

Rights Against Misleading Representations During Collections

Misleading representations during collections stand directly opposed to principles upheld by both state law and entities like the Federal Trade Commission overseeing trade practices nationwide—including those related specifically towards collecting consumer credit obligations.

Laypersons often find themselves misled over technical aspects associated with outstanding liabilities, which might include confusion regarding who actually owns said liability post-transfer between private entities operating within this sector—or whether certain fees charged atop the principal amount were indeed stipulated clearly beforehand per the original agreed terms.

Civil Liabilities and Penalties for Violating the FDCPA

Attorneys navigating the debt collection landscape must remain vigilant about adhering to the Fair Debt Collection Practices Act (FDCPA). When this federal statute is breached, severe penalties can ensue. These sanctions are designed not just as punishment but also as a deterrent against unfair debt collection practices.

Statutory Damages Imposed on Debt Collectors

The FDCPA clearly outlines that violations may lead to statutory damages for affected consumers. A breach of its provisions could result in actual damages being awarded. Moreover, additional damages up to $1,000 for individual actions may be imposed by courts without needing proof of actual harm or distress experienced by the debtor due to such infractions.

This mechanism serves both compensatory and punitive purposes. It compensates victims for any financial loss while penalizing collectors who stray from legal conduct. It’s crucial that lawyers and debt collectors understand these potential outcomes because they underscore how seriously transgressions are taken under federal law.

Enforcement Actions Taken Against Non-Compliant Entities

Beyond civil liabilities faced by violators of the FDCPA, enforcement actions stand as another formidable consequence initiated primarily by two bodies: The Federal Trade Commission (FTC) and Consumer Financial Protection Bureau (CFPB). These agencies wield administrative power over entities engaged in abusive debt collection tactics—empowered further through cooperation with other federal agencies like the Federal Reserve—to maintain compliance within industry standards.

To elucidate their role more precisely, when an infringement occurs—be it misleading representations or employing harassment methods—the FTC has historically stepped forward with cease-and-desist orders alongside monetary fines if necessary. Concurrently, CFPB can engage in rule-making activities directly affecting future operations of collections firms along with executing supervisory examinations reflecting current regulations.

Given the high stakes involved in debt collection, it’s essential for professionals to manage these cases with extreme care. They must stay aligned with all regulatory demands to avoid not only financial penalties but also lasting harm to their reputation. This commitment calls for an approach that is thorough, consistent, and clear-cut—leaving no room for doubt about their compliance.

FAQ: Key Facts About the Fair Debt Collection Practices Act (FDCPA)

What does the FDCPA regulate?

The FDCPA ensures fair and respectful debt collection practices, prohibiting harassment, deception, and abuse while protecting consumer rights.

What are consumers’ rights?

Consumers can dispute debts, request validation, and stop communication from collectors. These rights safeguard against wrongful or aggressive collection tactics.

What conduct is prohibited for debt collectors?

Debt collectors cannot harass, use deceptive tactics, or contact consumers outside of permitted hours (before 8 AM or after 9 PM).

What are the consequences of violating the FDCPA?

Violations can lead to lawsuits, statutory damages up to $1,000, and federal penalties from agencies like the FTC and CFPB.

Follow this summary to ensure fair practices and avoid legal risks.

Conclusion

So you’ve navigated the twists and turns of the Fair Debt Collection Practices Act. Remember, it’s not just about knowing consumers rights—it’s about actively utilizing the tools necessary to protect yourself as a collection firm and ensure you follow the law.

Amendments have shaped the legal scope for today’s world. Recall how harassment or deception by collectors is a big no-no.

Remember, verifying debts isn’t just a debtor’s right—it’s their shield against wrongful claims. And don’t forget: when rules are broken, stiff penalties can follow—empowering knowledge to be sure your firm stays on the fair side when actively collecting.

This insight doesn’t just help safeguard consumers’ wallets and peace of mind, it also steers debt collectors toward honorable conduct in their quest to collect what’s due. Keep these lessons close—they’re tools for financial health and justice under the Fair Debt Collection Practices Act.

Ready to take your practice to the next level of Debt Recovery? CMPOnline offers SaaS-based Debt Collection Software tailored specifically for lawyers like you. With our tools at your disposal, navigating through the debt collection industry becomes easier than ever before. Visit Case Master Pro and request a FREE DEMO today to start transforming how you handle Debt Collection cases!