In the broader context of debt recovery, understanding the intricacies of a demand letter to collect payment and recognizing the importance of details and the letter’s solid foundation is an investment of time well spent. This seemingly straightforward letter serves as the backbone to your legal claims as a debt collection lawyer. Whether you are a seasoned legal professional or someone seeking a few tips, this blog will guide you through the process of crafting a demand letter that makes a significant impact.

This simple yet powerful letter isn’t just about getting your money back—it’s also about asserting your rights and signaling to debtors that their non-payment won’t go unnoticed. This legally sound method may feel daunting initially but fear not, we’re here to walk you through every step.

By the end of this blog post, you’ll have a solid grasp on what these letters mean. You’ll also learn how to craft one effectively and legally.

Understanding Demand Letters to Collect Payment

A demand letter to collect payment serves as a formal request to an individual or business who owes you money. It’s more than just asking, it’s demanding payment in a legal manner.

Demand letters play an essential role in the debt collection process. They serve as the initial step before escalating matters to small claims court and are crucial when there is money owed that needs recovering.

The purpose of these letters is twofold: firstly, they inform the debtor about their obligation towards settling outstanding debts; secondly, they signal your seriousness and willingness to pursue any unpaid amounts legally if necessary.

Key Components of a Demand Letter

An effective demand letter includes several components, such as clearly outlining what is due, setting out terms for repayment, and establishing consequences should repayment not occur within set parameters. These could include late fees or potential legal action if required.

Making Your Request Legally Sound

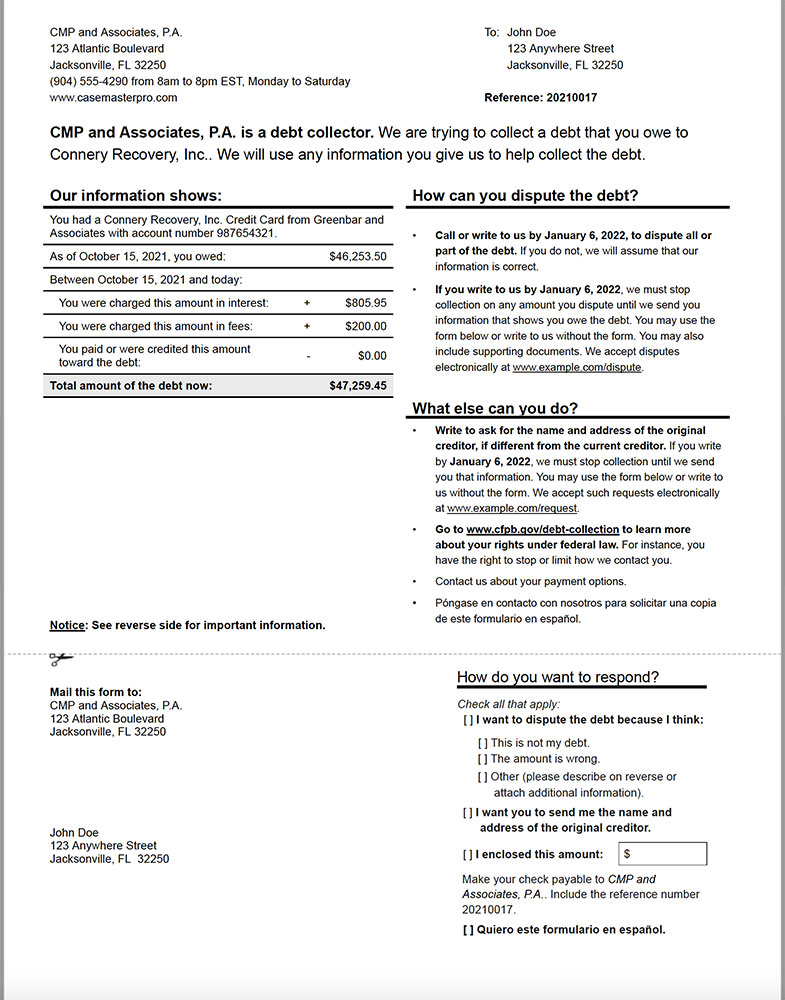

To ensure your demand holds up under scrutiny, make sure you’re basing it on solid evidence that proves both the existence of debt and its precise amount. The Fair Debt Collection Practices Act (FDCPA) sets clear guidelines on how this process must be conducted without violating consumer rights – failure to adhere can result in penalties or even lawsuits against you by aggrieved parties.

Sending Out Your Letter and Follow-up Measures

Certified mail with proof of delivery gives assurance that your letter was received while also providing important documentation should matters proceed further. Remember though, patience may be needed here – give enough time for them to respond before deciding next steps which might involve stronger demands or even court action.

Remember, the demand letter to collect payment is not just about demanding money owed. It’s also an opportunity to express your willingness to work out a resolution without involving court proceedings. Be firm but fair, and always be prepared to negotiate within reason.

Key Takeaway: Remember, this isn’t just a simple request for money owed. It’s laying out the facts clearly – how much is owed, why it’s owed, and what can happen if they ignore your plea. It’s about making sure you’ve got all your ducks in a row before things escalate further. So make sure everything is well documented. That way, when push comes to shove, you’ll be ready.

Drafting an Effective Demand Letter to Collect Payment

Writing a compelling demand letter involves careful thought and precision. The beginning of your demand letter should consist of a clear, succinct statement that carries legal power.

Steps to Follow When Writing a Demand Letter

The structure of your demand letter should start with clearly identifying the parties involved – yourself (or your client) and the debtor. Next, you need to outline the debt details including date incurred, services rendered, or products provided, if any, and other relevant information about the transaction in question.

To give it legal clout, make sure you reference any agreements or contracts between both parties supporting your claim. This makes it not just a simple payment request letter but rather a strong reminder of an outstanding obligation based on agreed terms.

Since this is no ordinary payment claim letter, but essentially a legally binding document once sent out from an attorney’s office, your tone should be professional yet firm throughout. It’s also important that you specify what actions will follow if payment isn’t made by the stated deadline, whether through small claims court proceedings or via another collection route.

Making Your Claim Legally Sound

A successful demand for payment hinges upon its legitimacy in the eyes of the law, therefore all calculations regarding the amount owed must be precise. You could use examples, such as late fees or interest applied according to contract terms to illustrate how final figures have been calculated.

Be sure though not to exceed the legal interest rates, which may differ across states. Always check local laws before proceeding with this type of calculation when drafting your demand notice for payment.

Sending Your Demand Letter and Following Up

You can opt for either certified mail with proof of delivery or digital options, depending on what best suits your circumstances, but remember to keep track of responses received as well as evidence of any attempts made to contact the debtor.

Staying persistent can pay off, and it also keeps the pressure on the debtor. But remember, a demand letter isn’t just about asking for money – it’s an open door for negotiation and fixing things without dragging it out in court.

Making Your Demand Clear and Legally Sound

When drafting a demand letter to collect payment, it’s crucial to make your demand clear and legally sound. This starts with the legal basis for your payment request, which needs to be solidly grounded in evidence of debt owed.

The amount you’re demanding should also accurately reflect what is owed. So, calculating the correct amount isn’t just about adding up invoices—interest, late fees, or other penalties according to contract terms or state laws may apply as well.

To increase the effectiveness of your demand letter and make sure it serves its purpose as a formal record of the debt being claimed, here are some points you need to consider:

Evidence of Debt Owed

Supporting documents like signed contracts, invoices, and emails discussing services rendered or products delivered help establish that there’s an actual obligation by the debtor. These documents give credence to your claim when debtors can see black on white proof that they owe money.

Detailed Calculation Breakdown

A detailed breakdown makes it easier for everyone involved if disputes arise over how much is due. Remember that clarity will go a long way towards ensuring timely repayment without further issues cropping up later down the line.

Fairness in Interest and Fees Application

While tacking on interest rates and penalty fees might seem tempting at first glance, think twice before doing so. You must adhere strictly within the bounds set by local regulations, not only out of respect towards debtor rights but also because courts won’t hesitate to strike down any excessive demands, which could even potentially lead to counterclaims against you.

Compliance with Legal Standards

The Consumer Financial Protection Bureau (CFPB) offers a validation notice template designed to verify compliance with guidelines for your demand letter. Employing tools such as CMPOnline, equipped with the preconfigured Regulation F validation notice template, facilitates seamless adherence to legal requirements for your firm.

By carefully crafting a strong demand letter for payment that is clear, legally sound, and backed by evidence of debt owed, you’re increasing your chances to get paid without needing to go through time-consuming court procedures.

Key Takeaway: Creating a demand letter to collect payment calls for clarity and legal soundness. Base your claim on solid evidence, like contracts or invoices, to show the debtor’s obligation. Calculate what’s owed accurately, considering any applicable interest or fees, but always stay within local regulations to avoid potential counterclaims. This approach increases chances of timely repayment without court hassles.

Sending Your Demand Letter and Following Up

Once you’ve written your demand letter for payment, the next steps are crucial. The method of sending and how you follow up can significantly impact the outcome.

To start, always send your demand letter via certified mail with proof of delivery. This allows you to track the document and provides legal evidence that it was received by the debtor. Remember, this is more than just a simple payment request letter—it’s a formal step in the debt recovery process.

Certified Mail: Proof of Delivery

Using certified mail gives credibility to your efforts in demanding payment. It shows seriousness about collecting what’s owed while also giving tangible proof that notice has been given to repay outstanding amounts.

The recipient usually signs upon receipt, which serves as an acknowledgment from their end too. But if they refuse or don’t pick up after multiple attempts? Don’t worry. A returned envelope unopened still constitutes legal notification under many jurisdictions’ laws.

Tracking Responses Effectively and Setting Clear Repayment Deadlines

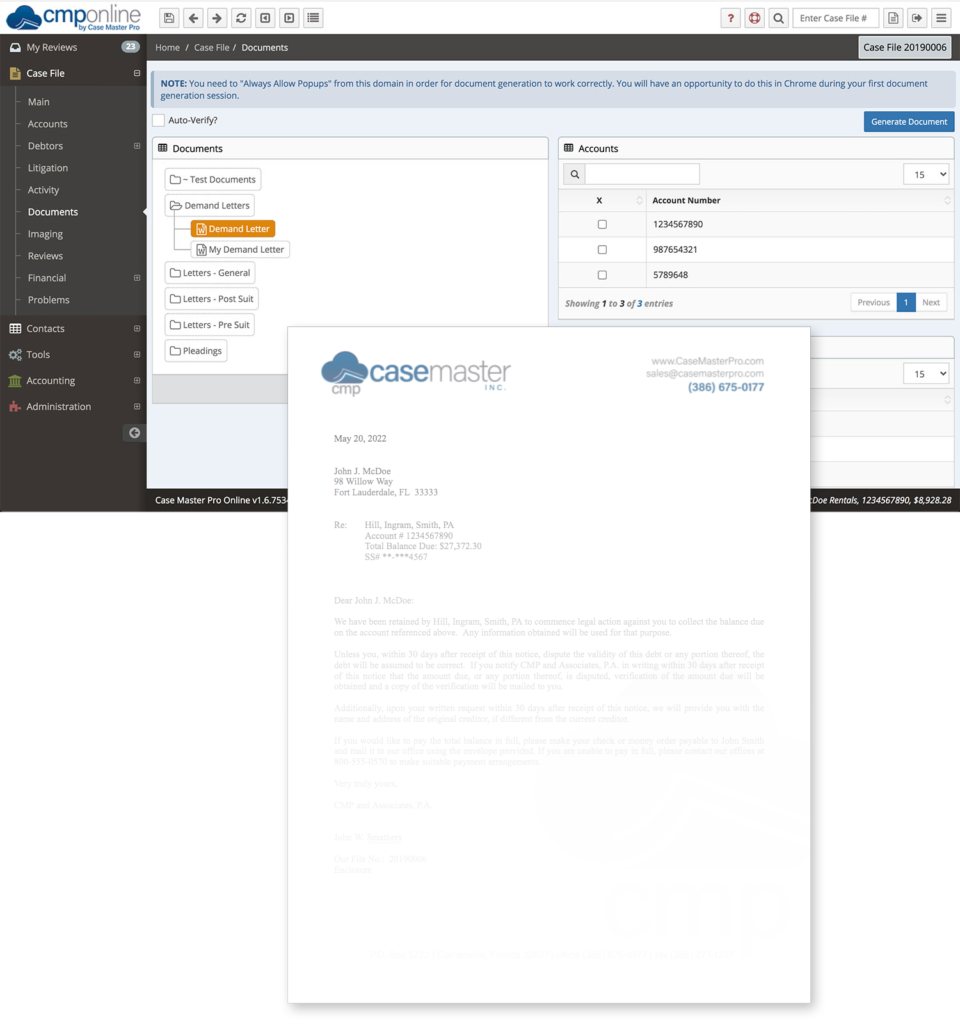

In the realm of debt recovery, the ability to track responses efficiently is pivotal, ensuring that no communication goes unnoticed or overlooked. This is where Case Master Pro emerges as an invaluable tool, specializing in the seamless tracking of all correspondence related to unpaid debts. CMPOnline’s imaging feature seamlessly integrates documents directly into each case file, offering a streamlined and paperless approach.

As responses may arrive through various channels such as email or post, Case Master Pro consolidates them into a centralized location, promoting organization and accessibility. This proves particularly advantageous as the matter progresses, potentially leading to a small claims court demand.

Beyond efficient tracking, a fundamental aspect of successful follow-up involves setting clear repayment deadlines within reasonable time frames. Case Master Pro aids in this process by providing reminders and prompts for key dates, ensuring that expectations are set transparently from both ends at the outset. This proactive approach minimizes the risk of confusion over the timelines involved in the settlement process, ultimately contributing to a more effective and streamlined debt recovery strategy.

Strategies for Follow-Up

If there’s no response or the debtor refuses to pay after receiving your demand letter, it might be time to consider other options. You could send a strong reminder letter for outstanding payment.

However, patience and persistence often bear fruit in these matters. Keep following up with courtesy but firmness—this demonstrates your commitment towards recovering what you’re owed without escalating the situation unnecessarily.

To wrap things up, remember that sending a demand letter is merely the first step. How you handle the next steps is just as crucial in successfully recovering debt. Consistency and persistence are key.

Key Takeaway: Writing and sending a demand letter to collect payment is just the start. It’s key to send it via certified mail, showing your seriousness about recovering what you’re owed, to keep track of all responses, and setting clear deadlines for repayment. If no response comes or the debtor refuses to pay, be patient but persistent in following up—consistency can often bring results.

Exploring Alternatives to Legal Action

In the event of an unpaid debt, resorting to legal action may appear like the only available choice. But before you decide to go down that path, consider exploring other avenues as alternatives to court, such as negotiating a settlement agreement or opting for mediation and arbitration.

Negotiating a settlement agreement can be less time-consuming and costly than going through litigation. This involves working directly with the debtor in order to agree on a repayment plan. It is crucial during these negotiations to maintain open lines of communication and strive towards an amicable resolution.

Mediation, another alternative, is often faster than court proceedings and allows both parties more control over the outcome. A neutral third party facilitates discussions between creditor and debtor, helping them find common ground.

The Role of Arbitration

If negotiation or mediation fails, arbitration could serve as another solution outside traditional court procedures. In this process, an arbitrator listens impartially to both sides before making binding decisions about payment terms.

The Importance of Flexibility in Debt Collection

A flexible approach in debt collection can significantly improve chances for successful recovery without resorting to formal litigation processes like small claims court cases, which are usually longer-term commitments involving hefty costs. By considering different strategies depending on your unique situation—negotiations first, followed by mediation or arbitration if needed—you can increase the likelihood for positive outcomes while preserving valuable relationships with clients.

Remember though, while alternatives may be cost-effective they’re not always applicable nor guarantee success. If your debtor refuses to negotiate, mediate, or arbitrate, then you may have no choice but to consider a legal action.

Debt collection is an inherently complex field and finding the right approach often requires expert help. Therefore, using specialized software like Case Master Pro can make this process more manageable by providing tools for tracking communications with debtors and maintaining organized records of all transactions.

Key Takeaway: When faced with unpaid debts, don’t rush to legal action. Instead, try negotiation or mediation for a less time-consuming and more cost effective resolution. If these fail, arbitration could be your next step. Use flexible strategies in debt collection to enhance recovery success while maintaining good client relationships. But remember, alternatives aren’t always applicable or successful. Sometimes you might need legal help.

Using Templates for Demand Letters

Drafting a robust demand letter can be a daunting task. Rather than beginning from scratch, leverage the power of your pre-approved, tried-and-tested demand letters. With CMPOnline’s Document Generation features, you have the ability to import these attorney-approved demand letters, saving them as templates for easy access within your firm. Importing these letters into the software not only streamlines the process but also provides a solid foundation, ensuring a professional and consistent starting point for your demand letters. This feature simplifies the task, allowing you to focus on tailoring the content to specific cases, ultimately enhancing efficiency and maintaining a high standard of communication with debtors.

Streamlined Document Management

Navigating through the Document Generation in CMPOnline is a breeze, thanks to its user-friendly and logically designed interface. The beauty of it? You control the document titles, eliminating the need for additional training on a new naming structure. Tailoring your legal files to your firm’s existing organization style is made easy, whether you’re crafting single-page letters or assembling complex packages.

Effortless Template Creation

Discover the power of customized templates with CMPOnline. You and your firm can design templates that perfectly align with your needs. The option to merge any field in CMP into a document allows for on-the-fly creation of new packages, significantly reducing setup time and boosting productivity. These templates, once created, become invaluable assets, saving time and effort as they are reused for similar cases. Learn how CMPOnline empowers you to effortlessly create and modify templates for consistent and professional document output.

The Advantages of Using Templates

Templates not only save time but also help ensure all necessary details are included in your letter – such as the exact amount owed, evidence supporting the claim, deadlines for payment, consequences of non-payment, and options for resolving disputes outside of court proceedings.

Templates also maintain consistency across multiple communications while ensuring compliance with consumer protection laws like the Fair Debt Collection Practices Act (FDCPA).

Finding the Right Template

In creating your templates, it’s important to consider factors specific to each case, like whether services were rendered but not paid for or if there was default in payments after an agreement was reached.

An ideal template should be flexible enough so adjustments can be made according to unique situations, yet rigid enough that it doesn’t deviate from core requirements of demanding outstanding debts legally and professionally.

Key Takeaway: Templates can be a lifesaver when crafting demand letters. They not only save time but also make sure you include all necessary details like the exact amount owed and deadlines for payment. Efficiency meets customization in crafting impactful demand letters with CMPOnline’s innovative templates.

Legal Considerations and Resources

The process of drafting a demand letter to collect payment is not just about demanding money owed. It also involves understanding legal considerations to make sure your demand letter stands up in court, if it comes to that.

Understanding Small Claims Court

If you’re pondering bringing your case before a small claims court, there are certain fundamentals to be aware of. Small claims courts handle cases where the amount disputed typically doesn’t exceed $5,000 or $10,000 depending on state laws. These courts provide an opportunity for parties involved in minor disputes over debt or other matters to have their case heard by a judge without the full formalities of a regular courtroom.

A strong reminder here is that before filing any lawsuit in small claims court regarding unpaid debts, it’s essential first to send a legally binding demand letter from an attorney. This document serves as proof that efforts were made outside of litigation to resolve the issue.

Consumer Protection Laws and Regulations

The FDCPA provides regulations for debt collectors when attempting to obtain unpaid sums, while ensuring the rights of consumers are safeguarded throughout this process. As per the FDCPA guidelines, when writing a sample legal demand letter for payment always include detailed information such as: why they owe what they owe, how much interest will accrue, potential additional costs if non-payment continues, etc. An important consideration is making sure your communication does not violate consumer protection regulations under the FDCPA, like harassing phone calls at odd hours or misleading threats about legal actions which may be considered unlawful. The FDCPA also stipulates that consumers have the right to dispute a debt and demand verification of it.

Consequently, the CFPB provides a Regulation F validation notice template, available in tools like CMPOnline, to ensure easy adherence to legal requirements in your demand letter.

To wrap things up, it’s key to grasp these legal aspects when handling payment disputes. Don’t forget: be straightforward in asking for due payments and always follow the necessary laws and rules.

Key Takeaway: Writing a demand letter for payment isn’t just about asking for money. It’s also about understanding the legal ins and outs to make sure your letter can stand its ground in court if it comes to that. Thinking of going through small claims court? Just remember, they deal with minor disputes and you need to send off a legally tight demand letter before anything else. And don’t forget about consumer protection laws like the FDCPA when chasing down payments; always ensure your communication includes detailed information.

FAQs in Relation to Demand Letter to Collect Payment

What should I do if the debtor ignores my demand letter?

If a debtor ignores your demand letter, consider initiating legal proceedings or exploring alternative actions based on the specifics of the case. Ensure compliance with all relevant laws and procedures.

Is it okay to send a demand letter via email?

Emailing your demand letter can work, but sending certified mail provides proof of delivery and gets more attention.

How do I write a late payment demand letter?

Your late payment letter should state the overdue amount clearly, give evidence of owed debt, and specify the deadline for settling up.

What is a Demand Letter?

A demand letter to collect payment is a written notice that is sent by one party to another, demanding payment of a debt or obligation. It is a formal document that outlines the amount owed, the reason for the debt, and the deadline by which payment must be made. The purpose of a demand letter is to inform the debtor of their legal obligation to pay the debt, and to provide them with a final opportunity to do so before legal action is taken against them.

Conclusion

Gaining proficiency in the craft of composing a request for reimbursement isn’t effortless, but you’re certainly on track. It’s about asserting rights and letting debtors know their non-payment isn’t unnoticed.

Remember, drafting an effective demand letter involves clear communication and ensuring legal soundness. Use strong reminders while maintaining professionalism to increase chances of receiving outstanding payments.

You’ve also learned alternative solutions like negotiation or mediation can help fix disputes without resorting to court action. There are templates available to give you a head start when creating your own letters along with the regulations and model validation forms put in place by the CFPB.

Above all, knowing how small claims courts work alongside understanding consumer protection laws can guide successful debt recovery efforts.

In conclusion, don’t be shy in demanding what’s rightfully yours; stand tall with knowledge as your armor!

Ready to take your practice to the next level of Debt Recovery? Case Master Pro offers SaaS-based Debt Collection Software tailored specifically for lawyers like you. With our tools at your disposal, navigating through the debt collection industry and merging your demand letter templates becomes easier than ever before. Visit Case Master Pro and request a FREE DEMO today to start transforming how you handle debt collection cases!